Introduction

This is the API reference and example documentation for Payment Highway. The easy and enjoyable card payment solution for mobile and online.

Payment Highway API consists of two parts:

- Form API - for displaying a secure card information input form

- Payment API - for charging and refunding a card and for reporting

Client Libraries

Java

https://github.com/PaymentHighway/paymenthighway-java-lib

PHP

https://github.com/PaymentHighway/paymenthighway-php-lib

JavaScript

https://github.com/PaymentHighway/paymenthighway-javascript-lib

Examples

Live example. Try it out here!

JavaScript

A simple JavaScript example using the JavaScript client library @ GitHub

Usage

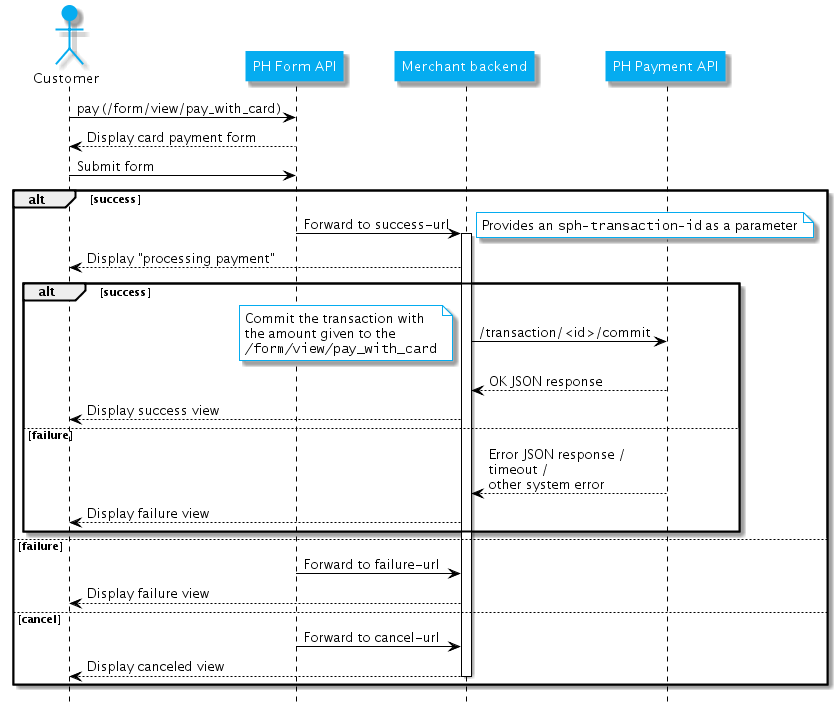

Make a Payment

- Show the form with Form API

POST /form/view/pay_with_card

—> returns ansph-transaction-idandsignatureas a GET parameters to the givensuccess-url - Commit the payment with Payment API

POST /transaction/<sph-transaction-id>/commit

—> returns a result in JSON formatting

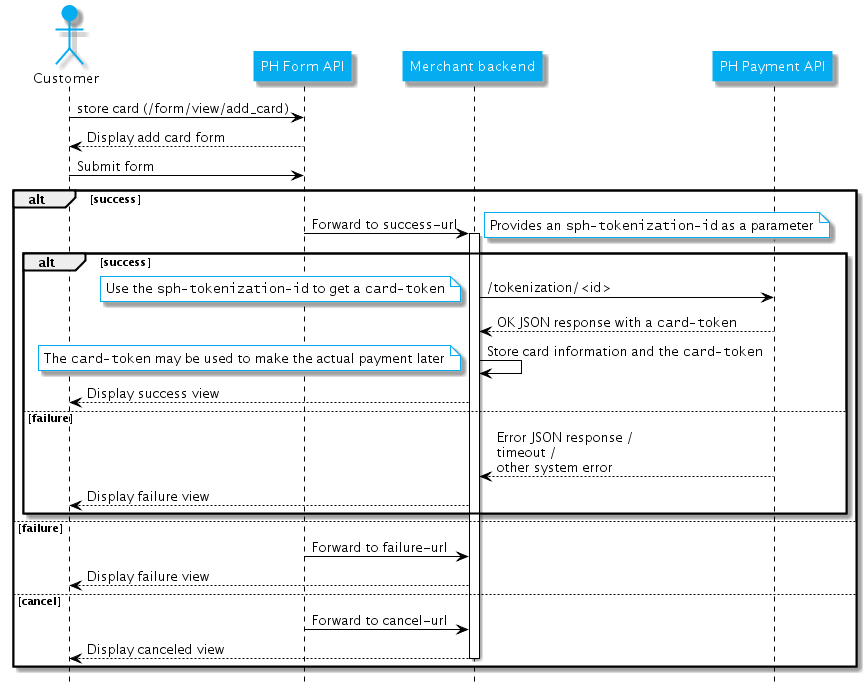

Store a Card

- Show the form with Form API

POST /form/view/add_card

—> returns ansph-tokenization-idandsignatureas a GET parameters to the givensuccess-url - Get the card token with Payment API

GET /tokenization/<sph-tokenization-id>

—> returns acard_tokenand card information in JSON formatting

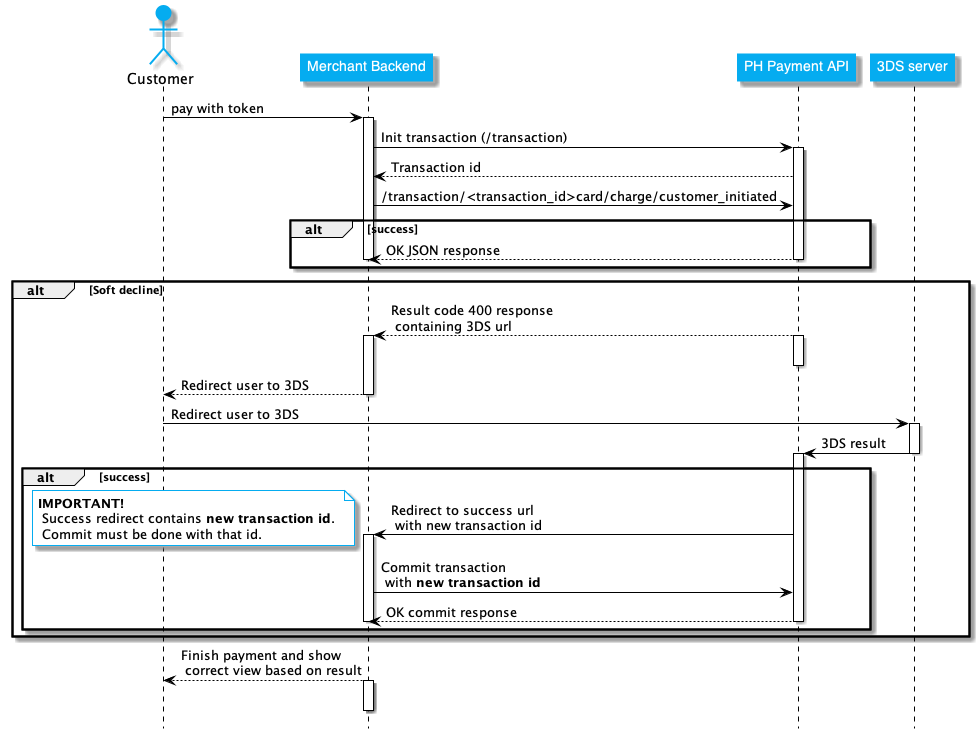

Pay with a Stored Card

- Initialize a transaction with Payment API

POST /transaction

—> returns a transactionidin JSON formatting - Charge the card with Payment API

POST /transaction/<id>/debit

—> returns a result in JSON formatting

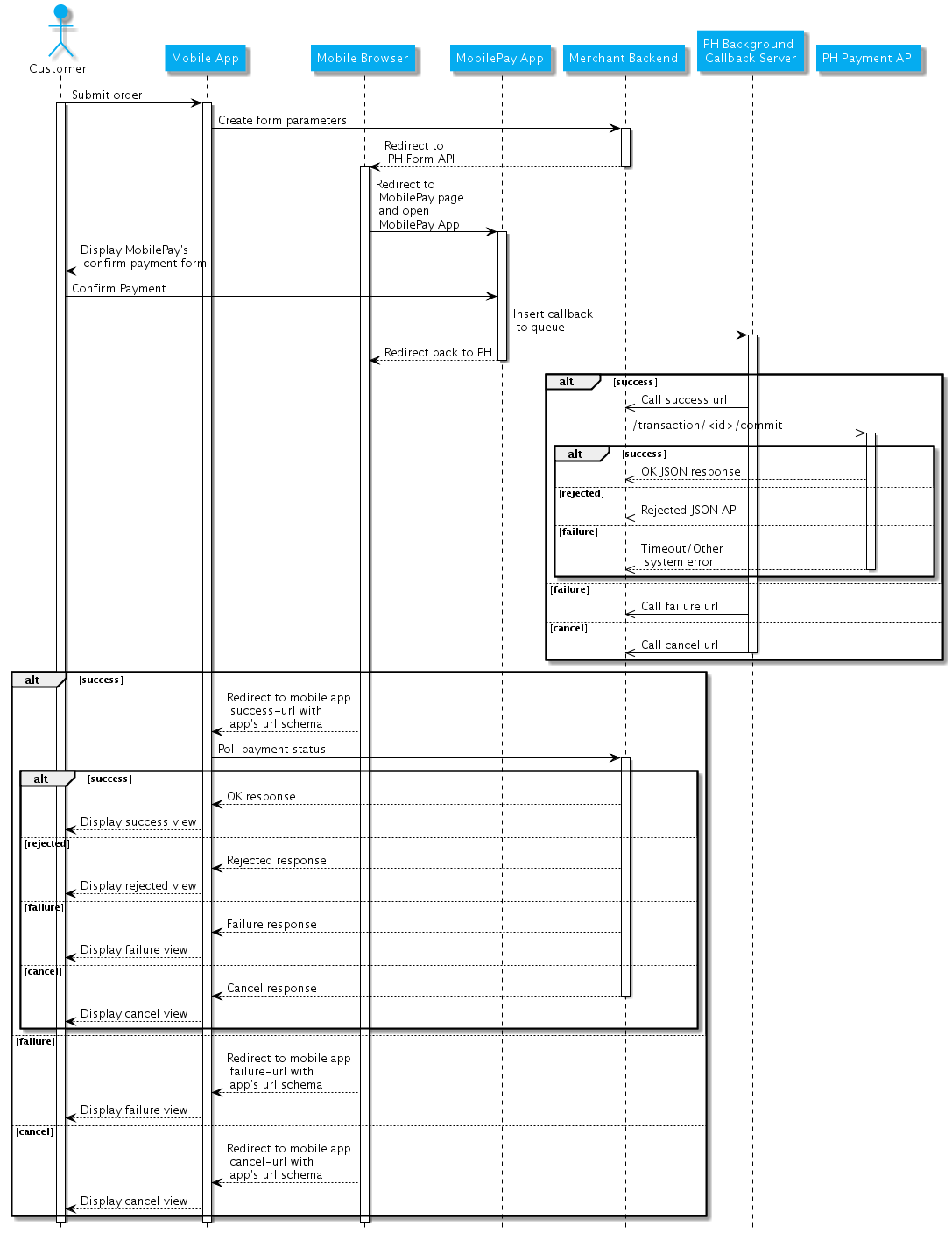

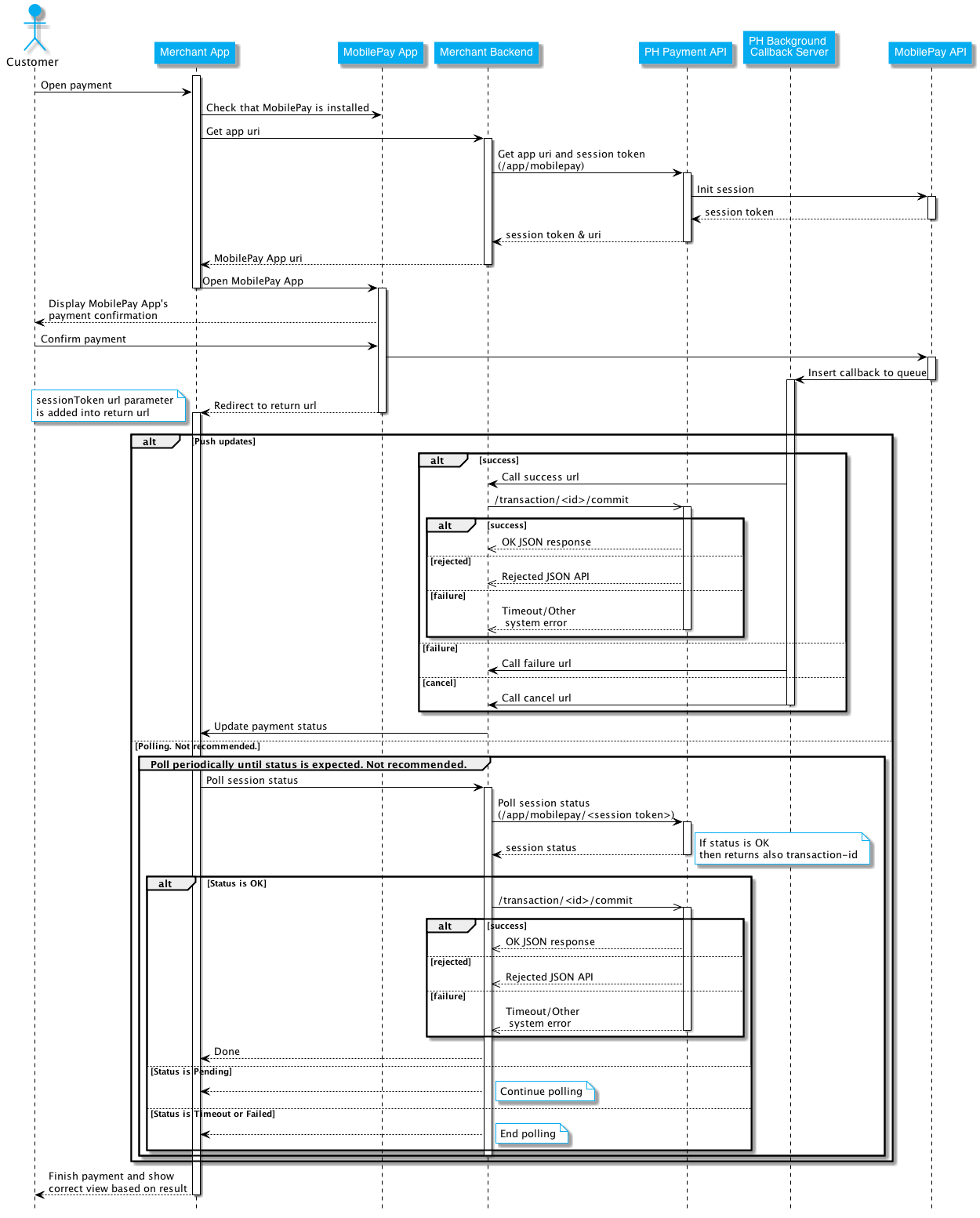

Pay with MobilePay

- Open MobilePay with Form API

POST /form/view/mobilepay

-> return ansph-transaction-idandsignatureas a GET parameters to the givensuccess-url - Commit payment with Payment API

POST /transaction/<sph-transaction-id>/commit

—> returns a result in JSON formatting

Development Sandbox

Base URL

The Payment Highway Sandbox environment is accessed on

https://v1-hub-staging.sph-test-solinor.com/

Merchant Account

The Sandbox Merchant Account uses the following credentials:

| Parameter | Value |

|---|---|

| sph-account | test |

| sph-merchant | test_merchantId |

| Account key | testKey |

| Account secret | testSecret |

Take a look at the signature calculation examples in the Form API and in the Payment API.

Sandbox credit cards

There are predefined card numbers that are accepted in the sandbox environment. Each card serves a different purpose in testing the API. For general declines, just input an incorrect CVC or expiry date.

| Card abilities | Card Number | Expiry date | CVC | Specialties |

|---|---|---|---|---|

| Tokenization OK Payment OK |

4153013999700313 | 11/2026 | 313 | Successful 3D Secure. 3DS form password "secret". |

| Tokenization OK Payment OK |

4153013999700321 | 11/2026 | 321 | Successful 3D Secure. 3DS form will be automatically completed. |

| Tokenization OK Payment OK |

4153013999700339 | 11/2026 | 339 | 3D Secure attempt. 3DS will be automatically attempted. |

| Tokenization (OK) Payment (OK) |

4153013999700347 | 11/2026 | 347 | 3D Secure fails. The "cardholder_authentication" response parameter will be "no". It is at discretion of the merchant to accept or reject unauthentication transactions. If the merchant decides to decline the payment, the transaction should be reverted. |

| Tokenization OK Payment FAIL |

4153013999700354 | 11/2026 | 354 | Successful 3D Secure. 3DS form password "secret". Insufficient funds in the test bank account. |

| Tokenization OK Payment OK with 3DS |

4153013999701162 | 11/2026 | 162 | Soft decline when charging saved card using Customer Initiated Transaction (requires 3DS). 3DS form password "secret". |

| Tokenization OK Payment OK with 3DS |

4153013999701170 | 11/2026 | 170 | Soft decline when charging saved card using Customer Initiated Transaction (requires 3DS). 3DS form will be automatically completed. |

| Tokenization OK Payment OK |

4153013999700024 | 11/2026 | 024 | Non-EU - "one leg out" card, not enrolled to 3DS. The "cardholder_authentication" response parameter will be "attempted". |

| Tokenization OK Payment FAIL |

4153013999700156 | 11/2026 | 156 | Non-EU - "one leg out" card, not enrolled to 3DS. Insufficient funds in the test bank account. |

| Tokenization OK Payment OK |

4153013999703002 | Any month and year | Any CVC | Partial approval on amount greater than 2. Returns partial approval of half the amount. Only for AFD customers. |

| Tokenization OK Payment OK |

4153013999704000 | Any month and year | Any CVC | Provides a network token, if enabled for the test merchant. |

| Tokenization OK Payment FAIL |

4153013999704018 | Any month and year | Any CVC | Provides a network token, if enabled for the test merchant. Insufficient funds in the test bank account for payments. |

| Tokenization OK Payment OK with 3DS |

4153013999704026 | Any month and year | Any CVC | Provides a network token, if enabled for the test merchant. Soft decline when charging saved card using Customer Initiated Transaction (requires 3DS). 3DS form password "secret". |

| Tokenization OK Payment OK with 3DS |

4153013999704034 | Any month and year | Any CVC | Provides a network token, if enabled for the test merchant. Soft decline when charging saved card or network token using Customer Initiated Transaction (requires 3DS). 3DS form password "secret". |

Form API

Payment Highway Form API allows merchants to tokenize payment cards and create payments using an HTML form interface.

Request and Response format

// Create a FormBuilder

String method = "POST";

String signatureKeyId = "testKey";

String signatureSecret = "testSecret";

String account = "test";

String merchant = "test_merchantId";

String serviceUrl = "https://v1-hub-staging.sph-test-solinor.com";

FormBuilder formBuilder = new FormBuilder(

method, signatureKeyId, signatureSecret, account, merchant,

serviceUrl

);

// Create a FormBuilder

signature_key_id = "testKey"

signature_secret = "testSecret"

account = "test"

merchant = "test_merchantId"

service_url = "https://v1-hub-staging.sph-test-solinor.com"

success_url = "https://www.paymenthighway.fi/"

failure_url = "https://paymenthighway.fi/dev/"

cancel_url = "https://solinor.com/"

language = "EN"

form_builder = PaymentHighway::FormBuilder.new(

signature_key_id, signature_secret, account, merchant,

service_url, success_url, failure_url, cancel_url, language)

var paymentHighway = require('paymenthighway-javascript-lib');

var method = 'POST';

var testKey = 'testKey';

var testSecret = 'testSecret';

var account = 'test';

var merchant = 'test_merchantId';

var serviceUrl = 'https://v1-hub-staging.sph-test-solinor.com';

var formBuilder = new paymentHighway.FormBuilder(

method,

testKey,

testSecret,

account,

merchant,

serviceUrl

);

<?php

use \Solinor\PaymentHighway\FormBuilder;

$method = "POST";

$signatureKeyId = "testKey";

$signatureSecret = "testSecret";

$account = "test";

$merchant = "test_merchantId";

$baseUrl = "https://v1-hub-staging.sph-test-solinor.com";

$successUrl = "https://example.com/success";

$failureUrl = "https://example.com/failure";

$cancelUrl = "https://example.com/cancel";

$language = "EN";

$formBuilder = new FormBuilder($method,

$signatureKeyId,

$signatureSecret,

$account,

$merchant,

$baseUrl,

$successUrl,

$failureUrl,

$cancelUrl,

$language);

Requests

The “sph”-prefixed form fields and the request signature should be calculated server side and set in the html form as hidden fields.

Responses

Responses are delivered to URLs given in the request and signed by using the same key as in the request. Response parameters are added as GET parameters to the URL.

When a user is redirected to the success-url, it means we have successfully completed processing of the request. It does not however mean the card payment or tokenization was accepted by the authorizing parties.

You will find out the actual result using the PaymentAPI (server-to-server) commit or tokenization requests.

A user is redirected to the failure-url, if processing of the request failed for example due to missing parameters, authentication issues or connectivity issues to the authorizing parties.

Important! Always validate the form redirection signature parameter to prevent tampering of the values!

Authentication

Authentication is based on a signature calculated from the merchant account information and from the other parameters prefixed with 'sph'.

Request signature calculation

Original POST data

POST

/form/view/pay_with_card

sph-account=test

sph-merchant=test_merchantId

sph-order=1000123A

sph-request-id=f47ac10b-58cc-4372-a567-0e02b2c3d479

sph-amount=990

sph-currency=EUR

sph-timestamp=2014-09-18T10:32:59Z

sph-success-url=https://merchant.example.com/payment/success

sph-failure-url=https://merchant.example.com/payment/failure

sph-cancel-url=https://merchant.example.com/payment/cancel

language=fi

description=Example payment of 10 balloons á 0,99EUR

signature=SPH1 testKey 960aeec47d172637325b15513b3a526e95c93ba74b5067da766f282573464d58

POST data included in the signature calculation, parameters sorted alphabetically

"POST

/form/view/pay_with_card

sph-account:test

sph-amount:990

sph-cancel-url:https://merchant.example.com/payment/cancel

sph-currency:EUR

sph-failure-url:https://merchant.example.com/payment/failure

sph-merchant:test_merchantId

sph-order:1000123A

sph-request-id:f47ac10b-58cc-4372-a567-0e02b2c3d479

sph-success-url:https://merchant.example.com/payment/success

sph-timestamp:2014-09-18T10:32:59Z

"

Authentication hash using "testSecret" as the keyValue and POST data from above:

HMAC-SHA256(keyValue, data) =>

960aeec47d172637325b15513b3a526e95c93ba74b5067da766f282573464d58

Signature is calculated from the request parameters with HMAC-SHA256 algorithm using one of the merchant secret keys. The signature value contains “SPH1”, the key ID and the calculated authentication hash as a hexadecimal string separated with spaces “ ” (0x20).

The authentication hash value is calculated from the authentication string using the chosen merchant secret key. The authentication string is formed from the request method, URI and the request parameters beginning with “sph-”-prefix. Values are trimmed and the key-value pairs are concatenated in alphabetical order by the key name. The parameter keys must be in lowercase. Each key and value is separated with a colon (“:”) and the different parameters are separated with a new line (“\n”) at the end of each value.

Response redirection signature calculation (success, failure and cancel urls)

Form redirection response example:

http://merchant-example-spring.sph-test-solinor.com/pay_with_card/success?sph-amount=1990&signature=SPH1+testKey+8b9b2eb519e289016ff8b6bb6112901ad64238a8035b6b06a179a1bcb178947e&sph-account=test&sph-currency=EUR&sph-merchant=test_merchantId&sph-transaction-id=24806fe4-c0ed-4baa-9044-14b15457ea6e&sph-order=1000123A&sph-timestamp=2016-05-17T07%3A08%3A27Z&sph-request-id=7475777a-b9f8-4c09-958c-b1ea47bdc0cb&sph-success=OK

"GET

sph-account:test

sph-amount:1990

sph-currency:EUR

sph-merchant:test_merchantId

sph-order:1000123A

sph-request-id:7475777a-b9f8-4c09-958c-b1ea47bdc0cb

sph-success:OK

sph-timestamp:2016-05-17T07:08:27Z

sph-transaction-id:24806fe4-c0ed-4baa-9044-14b15457ea6e

"

Authentication hash using "testSecret" as the keyValue and GET data from above:

HMAC-SHA256(keyValue, data) =>

8b9b2eb519e289016ff8b6bb6112901ad64238a8035b6b06a179a1bcb178947e

// Validate the response signature

SecureSigner secureSigner = new SecureSigner(signatureKeyId, signatureSecret);

if ( ! secureSigner.validateFormRedirect(requestParams)) {

throw new Exception("Invalid signature!");

}

// Validate the response signature

var secureSigner = new paymentHighway.SecureSigner(testKey, testSecret);

if(!secureSigner.validateFormRedirect(requestParams)) {

// Handle error

}

<?php

use Solinor\PaymentHighway\Model\Security\SecureSigner;

$secureSigner = new SecureSigner(signatureKeyId, signatureSecret);

try{

$secureSigner->validateFormRedirect($params)) {

}

catch(Exception $e) {

// Validation failed, handle here

}

Response parameters are formatted into a single value and HMAC-SHA256 signature is calculated with the same secret key as in the request. The signature value contains “SPH1”, the key ID and the calculated authentication hash as a hexadecimal string separated with spaces “ ” (0x20).

The authentication hash value is calculated from the authentication string using the chosen merchant secret key. The authentication string is formed from the method "GET", an empty URI "", the response parameters beginning with “sph-”-prefix and an empty body "". Values are trimmed and the key-value pairs are concatenated in alphabetical order (by the key name). The parameter keys must be in lowercase. Each key and value is separated with a colon (“:”) and the different parameters are separated with a new line (“\n”) at the end of each value.

Add Card

curl -i --data-urlencode '

sph-account=test

sph-merchant=test_merchantId

sph-request-id=f47ac10b-58cc-4372-a567-0e02b2c3d479

sph-timestamp=2014-09-18T10:32:59Z

sph-success-url=https://merchant.example.com/payment/success

sph-failure-url=https://merchant.example.com/payment/failure

sph-cancel-url=https://merchant.example.com/payment/cancel

language=fi

signature= SPH1 testKey 4eab87a16e3ee7bd530d778af0cb6c680dcaa52ed1913a9c1bd8ed5a8d689e3e' \

https://v1-hub-staging.sph-test-solinor.com/form/view/add_card

// Example common parameters for the following form generation functions

String successUrl = "https://www.paymenthighway.fi/";

String failureUrl = "https://paymenthighway.fi/dev/";

String cancelUrl = "https://solinor.com/";

String language = "EN";

// Generate Add Card form parameters

FormContainer formContainer = formBuilder.addCardParameters(successUrl, failureUrl, cancelUrl)

.language(language)

.build();

// read form parameters

String httpMethod = formContainer.getMethod();

String actionUrl = formContainer.getAction();

List<NameValuePair> fields = formContainer.getFields();

for (NameValuePair field : fields) {

/*

* Build the form for POST-request:

* <input type="hidden" name="field.getName()" value="field.getValue()">

* Or create GET-url:

* ?field.getName()=field.getValue()&...

*/

field.getName();

field.getValue();

}

// Generate Add Card form parameters

form_container = form_builder.add_card_parameters

// read form parameters

http_method = form_container.method

action_url = form_container.action

pairs = form_container.pairs // an array of PaymentHighway::NameValuePair

pairs.each do |pair|

name = pair.name

value = pair.value

end

// Example common parameters for the following form generation functions

var successUrl = 'https://example.com/success';

var failureUrl = 'https://example.com/failure';

var cancelUrl = 'https://example.com/cancel';

var language = 'EN';

// Generate Add Card form parameters

var formContainer = formBuilder.generateAddCardParameters(

successUri,

failureUri,

cancelUri,

language

);

// read form parameters

var httpMethod = formContainer.method;

var actionUrl = formContainer.getAction();

var fields = formContainer.nameValuePairs;

fields.forEach(function(field) {

/*

* Build the form for POST-request:

* <input type="hidden" name="name" value="value">

* Or create GET-url:

* ?name=value&...

*/

var name = field.first;

var value = field.second;

});

<?php

$form = $formBuilder->generateAddCardParameters();

// read form parameters

$httpMethod = $form->getMethod();

$actionUrl = $form->getAction();

$parameters = $form->getParameters();

foreach ($parameters as $key => $value) {

/*

* Build the form for POST-request:

* <input type="hidden" name="$key" value="$value">

* Or create GET-url:

* ?$key=$value&...

*/

echo $key .":". $value;

}

Adding a new card stores the payment card information to Payment Highway and returns a tokenization id that can be used to fetch a card token for payments.

Simple flow

- Show the form with Form API

POST /form/view/add_card

—> returns ansph-tokenization-idandsignatureas a GET parameters to the givensuccess-url - Get the card token with Payment API

GET /tokenization/<sph-tokenization-id>

—> returns acard_tokenand card information in JSON formatting

HTTP Request

POST /form/view/add_card

| Parameter | Data type | M/O | Description |

|---|---|---|---|

| sph-account | AN | M | Account identifier |

| sph-merchant | AN | M | Account merchant identifier |

| sph-request-id | UUID4 | M | Request identifier |

| sph-timestamp | TIMESTAMP | M | Request timestamp in ISO 8601 combined date and time in UTC. E.g. "2025-09-18T10:32:59Z" |

| sph-success-url | URL | M | Success URL the user is redirected to on success |

| sph-failure-url | URL | M | Failure URL the user is redirected to on failure |

| sph-cancel-url | URL | M | Cancel URL the user is redirected to on cancel |

| sph-webhook-success-url | URL | O | On success, server to server GET request will be made to this url with same parameters as success redirect. |

| sph-webhook-failure-url | URL | O | On failure, server to server GET request will be made to this url with same parameters as failure redirect. |

| sph-webhook-cancel-url | URL | O | On cancel, server to server GET request will be made to this url with same parameters as cancel redirect. |

| sph-webhook-delay | N | O | webhook call delay in seconds (MAX. 900). If omitted, default value 0 will be used. |

| sph-accept-cvc-required | BOOLEAN | O | Allow adding a card even if it requires CVC for payments. Defaults to false. |

| sph-api-version | VERSION | O | API version number |

| language | A | O | Two letter language code (ISO 639-1). Supported languages are DE, EN, ES, FI, FR, IT, NL, PT, PL, RU, SV. Defaults to browser language. |

| sph-skip-form-notifications | BOOLEAN | O | Skip errors displayed on the Payment Highway form and redirect directly to result URL (E.g. "Ecom payments disabled") . Default false. |

| sph-exit-iframe-on-result | BOOLEAN | O | Exit from iframe after redirection to result URLs. |

| sph-exit-iframe-on-three-d-secure | BOOLEAN | O | Exit from iframe when redirecting user to 3DS. |

| sph-use-three-d-secure | BOOLEAN | O | Force enable/disable 3DS authentication. Omit / null to use default configured parameter. Disable only if permitted by Your acquiring contract! |

| signature | ANS | M | Message signature in the format 'SPH1 key-id authentication-string' |

Webhooks have same parameters as success, failure and cancel responses.

Success Response for Add Card

On a successful operation the user is redirected to the given success URL sph-success-url.

When a user is redirected to the success-url, it means we have successfully completed processing of the request. It does not however mean the card payment or tokenization was accepted by the authorizing parties.

You will find out the actual result using the PaymentAPI (server-to-server) commit or tokenization requests.

| Parameter | Data type | Description |

|---|---|---|

| sph-account | AN | Account identifier from request |

| sph-merchant | AN | Account merchant identifier from request |

| sph-request-id | UUID4 | Request identifier from request |

| sph-api-version | VERSION | API version number used in the request |

| sph-session-id | UUID4 | Reference to the form session |

| sph-tokenization-id | UUID4 | Generated sph-tokenization-id |

| sph-timestamp | TIMESTAMP | Response timestamp in ISO 8601 combined date and time in UTC. E.g. 2025-09-18T10:33:49Z |

| sph-success | AN | Static text “OK” |

| signature | ANS | Message signature |

Failure Response for Add Card

On failure the user is redirected to the given failure URL sph-failure-url.

A user is redirected to the failure-url, if processing of the request failed for example due to missing parameters, authentication issues or connectivity issues to the authorizing parties.

| Parameter | Data type | Description |

|---|---|---|

| sph-account | AN | Account identifier from request |

| sph-merchant | AN | Account merchant identifier from request |

| sph-request-id | UUID4 | Request identifier from request |

| sph-api-version | VERSION | API version number used in the request |

| sph-session-id | UUID4 | Reference to the form session |

| sph-timestamp | TIMESTAMP | Response timestamp in ISO 8601 combined date and time in UTC. E.g. 2025-09-18T10:33:49Z |

| sph-failure | AN | Failure reason, one of:

|

| signature | ANS | Message signature |

Cancel Response for Add Card

If the user cancels the operation they are redirected to the given cancel URL sph-cancel-url.

| Parameter | Data type | Description |

|---|---|---|

| sph-account | AN | Account identifier from request |

| sph-merchant | AN | Account merchant identifier from request |

| sph-request-id | UUID4 | Request identifier from request |

| sph-api-version | VERSION | API version number used in the request |

| sph-session-id | UUID4 | Reference to the form session |

| sph-timestamp | TIMESTAMP | Response timestamp in ISO 8601 combined date and time in UTC. E.g. 2025-09-18T10:33:49Z |

| sph-cancel | AN | Cancel reason "CANCEL" |

| signature | ANS | Message signature |

Payment

curl -i --data-urlencode '

sph-account=test

sph-merchant=test_merchantId

sph-order=1000123A

sph-request-id=f47ac10b-58cc-4372-a567-0e02b2c3d479

sph-amount=990

sph-currency=EUR

sph-timestamp=2014-09-18T10:32:59Z

sph-success-url=https://merchant.example.com/payment/success

sph-failure-url=https://merchant.example.com/payment/failure

sph-cancel-url=https://merchant.example.com/payment/cancel

language=fi

description=Example payment of 10 balloons á 0,99EUR

signature= SPH1 testKey 960aeec47d172637325b15513b3a526e95c93ba74b5067da766f282573464d58' \

https://v1-hub-staging.sph-test-solinor.com/form/view/pay_with_card

// Generate Payment form parameters

String amount = "1990";

String currency = "EUR";

String orderId = "1000123A";

String description = "A Box of Dreams. 19,90€";

FormContainer formContainer = formBuilder.paymentParameters(successUrl, failureUrl, cancelUrl, amount, currency, orderId, description)

.build();

// read form parameters

String httpMethod = formContainer.getMethod();

String actionUrl = formContainer.getAction();

List<NameValuePair> fields = formContainer.getFields();

for (NameValuePair field : fields) {

/*

* Build the form for POST-request:

* <input type="hidden" name="field.getName()" value="field.getValue()">

* Or create GET-url:

* ?field.getName()=field.getValue()&...

*/

field.getName();

field.getValue();

}

// Generate Payment form parameters

amount = 1990

currency = "EUR"

order_id = "1000123A"

description = "A Box of Dreams. 19,90€"

form_container = form_builder.pay_with_card_parameters(amount, currency, order_id, description)

// read form parameters

http_method = form_container.method

action_url = form_container.action

pairs = form_container.pairs // an array of PaymentHighway::NameValuePair

pairs.each do |pair|

name = pair.name

value = pair.value

end

var amount = 1990;

var currency = 'EUR';

var orderId = '1000123A';

var description = 'A Box of Dreams. 19,90€';

var formContainer = formBuilder.generatePaymentParameters(

successUri,

failureUri,

cancelUri,

language,

amount,

currency,

orderId,

description

);

// read form parameters

var httpMethod = formContainer.method;

var actionUrl = formContainer.getAction();

var fields = formContainer.nameValuePairs;

fields.forEach(function(field) {

/*

* Build the form for POST-request:

* <input type="hidden" name="name" value="value">

* Or create GET-url:

* ?name=value&...

*/

var name = field.first;

var value = field.second;

});

<?php

$amount = "1990";

$currency = "EUR";

$orderId = "1000123A";

$description = "A Box of Dreams. 19,90€";

$form = $formBuilder->generatePaymentParameters($amount, $currency, $orderId, $description);

// read form parameters

$httpMethod = $form->getMethod();

$actionUrl = $form->getAction();

$parameters = $form->getParameters();

foreach ($parameters as $key => $value) {

/*

* Build the form for POST-request:

* <input type="hidden" name="$key" value="$value">

* Or create GET-url:

* ?$key=$value&...

*/

echo $key .":". $value;

}

The payment card form is shown in the Payment Highway. The response to the success-url contains a sph-transaction-id for committing the transaction through the Payment API.

Simple flow

- Show the form with Form API

POST /form/view/pay_with_card

—> returns ansph-transaction-idandsignatureas a GET parameters to the givensuccess-url - Commit the payment with Payment API

POST /transaction/<sph-transaction-id>/commit

—> returns a result in JSON formatting

HTTP Request

POST /form/view/pay_with_card

| Parameter | Data type | M/O | Description |

|---|---|---|---|

| sph-account | AN | M | Account identifier |

| sph-merchant | AN | M | Account merchant identifier |

| sph-order | ORDER-ID | M | Merchant defined order identifier. Should be unique per transaction. |

| sph-request-id | UUID4 | M | Request identifier |

| sph-amount | N | M | Amount in the lowest currency unit. E.g. 99,00 € = 9900 |

| sph-currency | A | M | Currency code "EUR" |

| sph-timestamp | TIMESTAMP | M | Request timestamp in ISO 8601 combined date and time in UTC. E.g. "2025-09-18T10:32:59Z" |

| sph-success-url | URL | M | Success URL user is redirected to on success |

| sph-failure-url | URL | M | Failure URL user is redirected to on failure |

| sph-cancel-url | URL | M | Cancel URL user is redirected to on cancel |

| sph-webhook-success-url | URL | O | On success, server to server GET request will be made to this url with same parameters as success redirect. |

| sph-webhook-failure-url | URL | O | On failure, server to server GET request will be made to this url with same parameters as failure redirect. |

| sph-webhook-cancel-url | URL | O | On cancel, server to server GET request will be made to this url with same parameters as cancel redirect. |

| sph-webhook-delay | N | O | Webhook call delay in seconds (MAX. 900). If omitted, default value 0 will be used. |

| sph-api-version | VERSION | O | API version number |

| language | A | O | Language code (ISO 639-1). Supported languages are DE, EN, ES, FI, FR, IT, NL, PT, PL, RU, SV. Defaults to browser language. |

| description | ANS | O | The order description shown to the user |

| sph-skip-form-notifications | BOOLEAN | O | Skip errors displayed on the Payment Highway form and redirect directly to result URL (E.g. "Ecom payments disabled") . Default false. |

| sph-exit-iframe-on-result | BOOLEAN | O | Exit from iframe after redirection to result URLs. |

| sph-exit-iframe-on-three-d-secure | BOOLEAN | O | Exit from iframe when redirecting user to 3DS. |

| sph-use-three-d-secure | BOOLEAN | O | Force enable/disable 3DS authentication. Omit / null to use default configured parameter. Disable only if permitted by Your acquiring contract! |

| sph-reference-number | AN | O | Reference number. In RF-format or in Finnish reference number format. Used only when transactions are configured to be settled one by one. |

| sph-splitting-merchant-id | N | O | Sub-merchant ID from the settlements provider. Not to be confused with the sph-merchant value. |

| sph-splitting-amount | N | O | The amount settled to the sub-merchant's account. The rest will be considered as the main merchant's commission. In the smallest currency unit. E.g. 99.99 € = 9999. |

| signature | ANS | M | Message signature in the format 'SPH1 key-id authentication-string' |

Webhooks have same parameters as success, failure and cancel responses.

Success Response for Payment

On a successful operation the user is redirected to the given success URL sph-success-url.

When a user is redirected to the success-url, it means we have successfully completed processing of the request. It does not however mean the card payment or tokenization was accepted by the authorizing parties.

You will find out the actual result using the PaymentAPI (server-to-server) commit or tokenization requests.

| Parameter | Data type | Description |

|---|---|---|

| sph-account | AN | Account identifier |

| sph-merchant | AN | Account merchant identifier |

| sph-order | ORDER-ID | Merchant defined order identifier |

| sph-request-id | UUID4 | Request identifier |

| sph-api-version | VERSION | API version number used in the request |

| sph-session-id | UUID4 | Reference to the form session |

| sph-amount | N | Amount in the lowest currency unit. E.g. 99,00 € = 9900 |

| sph-currency | A | Currency code "EUR" |

| sph-transaction-id | UUID4 | Payment transaction identifier |

| sph-timestamp | TIMESTAMP | Request timestamp in ISO 8601 combined date and time in UTC. E.g. "2025-09-18T10:32:59Z" |

| sph-success | AN | Static text “OK” |

| signature | ANS | Message signature |

Failure Response for Payment

On failure the user is redirected to the given failure URL sph-failure-url.

A user is redirected to the failure-url, if processing of the request failed for example due to missing parameters, authentication issues or connectivity issues to the authorizing parties.

| Parameter | Data type | Description |

|---|---|---|

| sph-account | AN | Account identifier from request |

| sph-merchant | AN | Account merchant identifier from request |

| sph-order | ORDER-ID | Merchant defined order identifier |

| sph-request-id | UUID4 | Request identifier from request |

| sph-api-version | VERSION | API version number used in the request |

| sph-session-id | UUID4 | Reference to the form session |

| sph-timestamp | TIMESTAMP | Response timestamp in ISO 8601 combined date and time in UTC. E.g. 2025-09-18T10:33:49Z |

| sph-failure | AN | Failure reason, one of:

|

| signature | ANS | Message signature |

Cancel Response for Payment

If the user cancels the operation they are redirected to the given cancel URL sph-cancel-url.

| Parameter | Data type | Description |

|---|---|---|

| sph-account | AN | Account identifier from request |

| sph-merchant | AN | Account merchant identifier from request |

| sph-order | ORDER-ID | Merchant defined order identifier |

| sph-request-id | UUID4 | Request identifier from request |

| sph-api-version | VERSION | API version number used in the request |

| sph-session-id | UUID4 | Reference to the form session |

| sph-timestamp | TIMESTAMP | Response timestamp in ISO 8601 combined date and time in UTC. E.g. 2025-09-18T10:33:49Z |

| sph-cancel | AN | Cancel reason "CANCEL" |

| signature | ANS | Message signature |

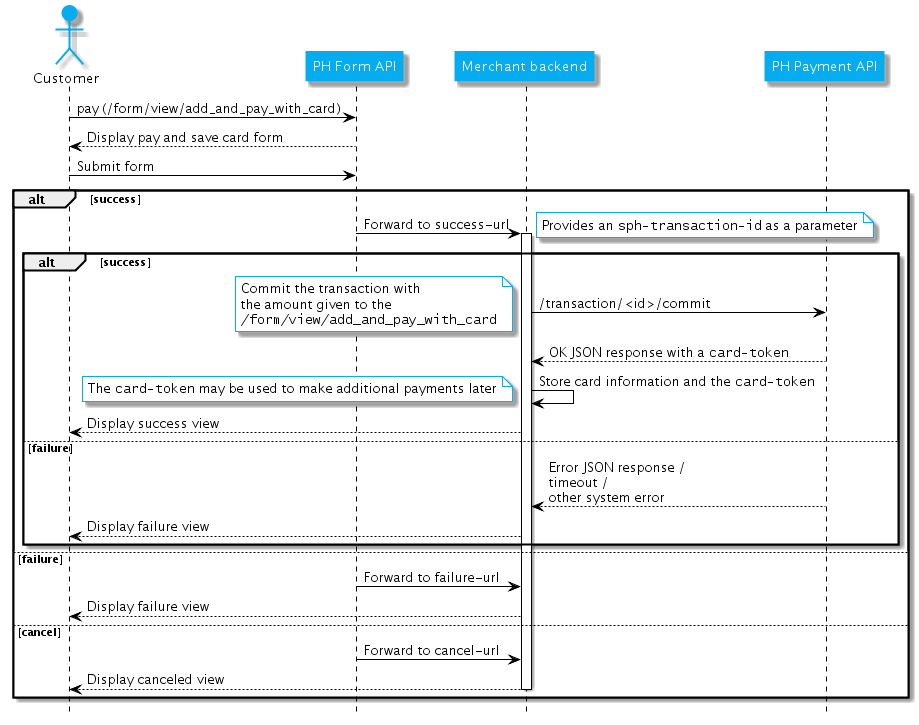

Payment & Add Card

curl -i --data-urlencode '

sph-account=test

sph-merchant=test_merchantId

sph-order=1000123A

sph-request-id=f47ac10b-58cc-4372-a567-0e02b2c3d479

sph-amount=990

sph-currency=EUR

sph-timestamp=2014-09-18T10:32:59Z

sph-success-url=https://merchant.example.com/payment/success

sph-failure-url=https://merchant.example.com/payment/failure

sph-cancel-url=https://merchant.example.com/payment/cancel

language=fi

description=Example payment of 10 balloons á 0,99EUR

signature= SPH1 testKey af9cf1b9a967f6415bb8c4dea8629db0d47edf8ee037c8af1a8bb0eb5aca68e1' \

https://v1-hub-staging.sph-test-solinor.com/form/view/add_and_pay_with_card

// Generate Add Card And Payment form parameters

String amount = "1990";

String currency = "EUR";

String orderId = "1000123A";

String description = "A Box of Dreams. 19,90€";

FormContainer formContainer = formBuilder.addCardAndPaymentParameters(

successUrl,

failureUrl,

cancelUrl,

amount,

currency,

orderId,

description

)

.build();

// read form parameters

String httpMethod = formContainer.getMethod();

String actionUrl = formContainer.getAction();

List<NameValuePair> fields = formContainer.getFields();

for (NameValuePair field : fields) {

/*

* Build the form for POST-request:

* <input type="hidden" name="field.getName()" value="field.getValue()">

* Or create GET-url:

* ?field.getName()=field.getValue()&...

*/

field.getName();

field.getValue();

}

// Generate Add Card And Payment form parameters

amount = 1990

currency = "EUR"

order_id = "1000123A"

description = "A Box of Dreams. 19,90€"

form_container = form_builder.add_and_pay_with_card_parameters(amount, currency, order_id, description)

// read form parameters

http_method = form_container.method

action_url = form_container.action

pairs = form_container.pairs // an array of PaymentHighway::NameValuePair

pairs.each do |pair|

name = pair.name

value = pair.value

end

// Generate Add Card And Payment form parameters

var amount = 1990;

var currency = 'EUR';

var orderId = '1000123A';

var description = 'A Box of Dreams. 19,90€';

var formContainer = formBuilder.generateAddCardAndPaymentParameters(

successUri,

failureUri,

cancelUri,

language,

amount,

currency,

orderId,

description

);

// read form parameters

var httpMethod = formContainer.method;

var actionUrl = formContainer.getAction();

var fields = formContainer.nameValuePairs;

fields.forEach(function(field) {

/*

* Build the form for POST-request:

* <input type="hidden" name="name" value="value">

* Or create GET-url:

* ?name=value&...

*/

var name = field.first;

var value = field.second;

});

<?php

$amount = "1990";

$currency = "EUR";

$orderId = "1000123A";

$description = "A Box of Dreams. 19,90€";

$form = $formBuilder->generateAddCardAndPaymentParameters($amount, $currency, $orderId, $description);

// read form parameters

$httpMethod = $form->getMethod();

$actionUrl = $form->getAction();

$parameters = $form->getParameters();

foreach ($parameters as $key => $value) {

/*

* Build the form for POST-request:

* <input type="hidden" name="$key" value="$value">

* Or create GET-url:

* ?$key=$value&...

*/

echo $key .":". $value;

}

This method combines a payment and adding a new card to allow getting the card token after a successful payment with a single request.

HTTP Request

POST /form/view/add_and_pay_with_card

The request and response parameters are exactly the same as in the Payment.

Payment with token and CVC

The CVC Form is shown in the Payment Highway. The response to the success-url contains a sph-transaction-id for committing the transaction through the Payment API.

HTTP Request

POST /form/view/pay_with_token_and_cvc

| Parameter | Data type | M/O | Description |

|---|---|---|---|

| sph-account | AN | M | Account identifier |

| sph-merchant | AN | M | Account merchant identifier |

| sph-order | ORDER-ID | M | Merchant defined order identifier. Should be unique per transaction. |

| sph-request-id | UUID4 | M | Request identifier |

| sph-amount | N | M | Amount in the lowest currency unit. E.g. 99,00 € = 9900 |

| sph-currency | A | M | Currency code "EUR" |

| sph-timestamp | TIMESTAMP | M | Request timestamp in ISO 8601 combined date and time in UTC. E.g. "2025-09-18T10:32:59Z" |

| sph-success-url | URL | M | Success URL user is redirected to on success |

| sph-failure-url | URL | M | Failure URL user is redirected to on failure |

| sph-cancel-url | URL | M | Cancel URL user is redirected to on cancel |

| sph-webhook-success-url | URL | O | On success, server to server GET request will be made to this url with same parameters as success redirect. |

| sph-webhook-failure-url | URL | O | On failure, server to server GET request will be made to this url with same parameters as failure redirect. |

| sph-webhook-cancel-url | URL | O | On cancel, server to server GET request will be made to this url with same parameters as cancel redirect. |

| sph-webhook-delay | N | O | webhook call delay in seconds (MAX. 900). If omitted, default value 0 will be used. |

| sph-token | UUID4 | M | The card token to charge. |

| sph-api-version | VERSION | O | API version number |

| language | A | O | Language code (ISO 639-1). Supported languages are DE, EN, ES, FI, FR, IT, NL, PT, PL, RU, SV. Defaults to browser language. |

| description | ANS | O | The order description shown to the user |

| sph-skip-form-notifications | BOOLEAN | O | Skip errors displayed on the Payment Highway form and redirect directly to result URL (E.g. "Ecom payments disabled") . Default false. |

| sph-exit-iframe-on-result | BOOLEAN | O | Exit from iframe after redirection to result URLs. |

| sph-exit-iframe-on-three-d-secure | BOOLEAN | O | Exit from iframe when redirecting user to 3DS. |

| sph-use-three-d-secure | BOOLEAN | O | Force enable/disable 3DS authentication. Omit / null to use default configured parameter. Disable only if permitted by Your acquiring contract! |

| sph-reference-number | AN | O | Reference number. In RF-format or in Finnish reference number format. Used only when transactions are configured to be settled one by one. |

| sph-splitting-merchant-id | N | O | Sub-merchant ID from the settlements provider. Not to be confused with the sph-merchant value. |

| sph-splitting-amount | N | O | The amount settled to the sub-merchant's account. The rest will be considered as the main merchant's commission. In the smallest currency unit. E.g. 99.99 € = 9999. |

| signature | ANS | M | Message signature in the format 'SPH1 key-id authentication-string' |

Webhooks have same parameters as success, failure and cancel responses.

Failure Response for Payment with token and CVC

On failure the user is redirected to the given failure URL sph-failure-url.

A user is redirected to the failure-url, if processing of the request failed for example due to missing parameters, authentication issues or connectivity issues to the authorizing parties.

| Parameter | Data type | Description |

|---|---|---|

| sph-account | AN | Account identifier from request |

| sph-merchant | AN | Account merchant identifier from request |

| sph-order | ORDER-ID | Merchant defined order identifier |

| sph-request-id | UUID4 | Request identifier from request |

| sph-api-version | VERSION | API version number used in the request |

| sph-session-id | UUID4 | Reference to the form session |

| sph-timestamp | TIMESTAMP | Response timestamp in ISO 8601 combined date and time in UTC. E.g. 2025-09-18T10:33:49Z |

| sph-failure | AN | Failure reason, one of:

|

| signature | ANS | Message signature |

Success and Cancel Responses

The Success and Cancel Responses are exactly the same as in the Payment.

When a user is redirected to the success-url, it means we have successfully completed processing of the request. It does not however mean the card payment or tokenization was accepted by the authorizing parties.

You will find out the actual result using the PaymentAPI (server-to-server) commit or tokenization requests.

Payment with MobilePay

curl -i --data-urlencode '

sph-account=test

sph-merchant=test_merchantId

sph-order=1000123A

sph-request-id=f47ac10b-58cc-4372-a567-0e02b2c3d479

sph-amount=990

sph-currency=EUR

sph-timestamp=2014-09-18T10:32:59Z

sph-success-url=https://merchant.example.com/payment/success

sph-failure-url=https://merchant.example.com/payment/failure

sph-cancel-url=https://merchant.example.com/payment/cancel

language=fi

description=Example payment of 10 balloons á 0,99EUR

signature= SPH1 testKey af9cf1b9a967f6415bb8c4dea8629db0d47edf8ee037c8af1a8bb0eb5aca68e1' \

https://v1-hub-staging.sph-test-solinor.com/form/view/mobilepay

// Generate Add Card And Payment form parameters

String amount = "1990";

String currency = "EUR";

String orderId = "1000123A";

String description = "A Box of Dreams. 19,90€";

Boolean exitIframeOnResult = null;

String shopLogoUrl = "https://foo.bar/biz.png";

FormContainer formContainer = formBuilder.mobilePayParametersBuilder(

successUrl,

failureUrl,

cancelUrl,

amount,

currency,

orderId,

description,

exitIframeOnResult,

shopLogoUrl

)

.build();

// read form parameters

String httpMethod = formContainer.getMethod();

String actionUrl = formContainer.getAction();

List<NameValuePair> fields = formContainer.getFields();

for (NameValuePair field : fields) {

/*

* Build the form for POST-request:

* <input type="hidden" name="field.getName()" value="field.getValue()">

* Or create GET-url:

* ?field.getName()=field.getValue()&...

*/

field.getName();

field.getValue();

}

// Generate Add Card And Payment form parameters

var amount = 1990;

var currency = 'EUR';

var orderId = '1000123A';

var description = 'A Box of Dreams. 19,90€';

var exitIframeOnResult = undefined;

var shopLogoUrl = 'https://foo.bar/biz.png';

var formContainer = formBuilder.generatePayWithMobilePayParameters(

successUri,

failureUri,

cancelUri,

language,

amount,

currency,

orderId,

description,

exitIframeOnResult,

shopLogoUrl

);

// read form parameters

var httpMethod = formContainer.method;

var actionUrl = formContainer.getAction();

var fields = formContainer.nameValuePairs;

fields.forEach(function(field) {

/*

* Build the form for POST-request:

* <input type="hidden" name="name" value="value">

* Or create GET-url:

* ?name=value&...

*/

var name = field.first;

var value = field.second;

});

<?php

$amount = "1990";

$currency = "EUR";

$orderId = "1000123A";

$description = "A Box of Dreams. 19,90€";

$exitIframeOnResult = null;

$shopLogoUrl = "https://foo.bar/biz.png";

$form = $formBuilder->generatePayWithMobilePayParameters(

$amount,

$currency,

$orderId,

$description,

$exitIframeOnResult,

$shopLogoUrl

);

// read form parameters

$httpMethod = $form->getMethod();

$actionUrl = $form->getAction();

$parameters = $form->getParameters();

foreach ($parameters as $key => $value) {

/*

* Build the form for POST-request:

* <input type="hidden" name="$key" value="$value">

* Or create GET-url:

* ?$key=$value&...

*/

echo $key .":". $value;

}

This method opens either Danske Bank's MobilePay page or Danske Bank's MobilePay application, depending if user is making payment with handheld device or PC.

Your card will not be charged.

Simple flow

- Open MobilePay with Form API

POST /form/view/mobilepay

-> return ansph-transaction-idandsignatureas a GET parameters to the givensuccess-url - Commit payment with Payment API

POST /transaction/<sph-transaction-id>/commit

—> returns a result in JSON formatting

HTTP Request

POST /form/view/mobilepay

| Parameter | Data type | M/O | Description |

|---|---|---|---|

| sph-account | AN | M | Account identifier |

| sph-merchant | AN | M | Account merchant identifier |

| sph-order | ORDER-ID | M | Merchant defined order identifier. Should be unique per transaction. |

| sph-request-id | UUID4 | M | Request identifier |

| sph-amount | N | M | Amount in the lowest currency unit. E.g. 99,00 € = 9900 |

| sph-currency | A | M | Currency code "EUR" |

| sph-shop-logo-url | URL | O | The logo must be 250x250 pixel in .png format and must be hosted on a HTTPS (secure) server. |

| sph-mobilepay-phone-number | AN | O | Customer phone number with country code e.q. +358449876543. Makes it easier for the customer to identify himself toward the MPO Website. |

| sph-mobilepay-shop-name | Max 100 AN | O | Name of the shop/merchant. MobilePay app displays this under the shop logo. If omitted, the merchant name from PH is used. |

| sph-timestamp | TIMESTAMP | M | Request timestamp in ISO 8601 combined date and time in UTC. E.g. "2025-09-18T10:32:59Z" |

| sph-success-url | URL | M | Success URL user is redirected to on success |

| sph-failure-url | URL | M | Failure URL user is redirected to on failure |

| sph-webhook-success-url | URL | O | On success, server to server GET request will be made to this url with same parameters as success redirect. |

| sph-webhook-failure-url | URL | O | On failure, server to server GET request will be made to this url with same parameters as failure redirect. |

| sph-webhook-cancel-url | URL | O | On cancel, server to server GET request will be made to this url with same parameters as cancel redirect. |

| sph-webhook-delay | N | O | webhook call delay in seconds (MAX. 900). If omitted, default value 0 will be used. |

| sph-cancel-url | URL | M | Cancel URL user is redirected to on cancel |

| sph-api-version | VERSION | O | API version number |

| language | A | O | Language code (ISO 639-1). Supported languages are DE, EN, ES, FI, FR, IT, NL, PT, PL, RU, SV. Defaults to browser language. |

| description | ANS | O | The order description shown to the user |

| sph-exit-iframe-on-result | BOOLEAN | O | Exit from iframe after redirection to result URLs. |

| sph-reference-number | AN | O | Reference number. In RF-format or in Finnish reference number format. Used only when transactions are configured to be settled one by one. |

| sph-splitting-merchant-id | N | O | Sub-merchant ID from the settlements provider. Not to be confused with the sph-merchant value. |

| sph-splitting-amount | N | O | The amount settled to the sub-merchant's account. The rest will be considered as the main merchant's commission. In the smallest currency unit. E.g. 99.99 € = 9999. |

| signature | ANS | M | Message signature in the format 'SPH1 key-id authentication-string' |

About shop logo in MobilePay

- The logo must be 250x250 pixel in .png format.

- MPO will show a default logo in the app if this is empty or the image location doesn’t exist.

- Once a ShopLogoURL has been sent to MPOnline the .png-file on that URL must never be changed. If the shop wants a new (or more than one) logo, a new ShopLogoURL must be used.

- The logo must be hosted on a HTTPS (secure) server.

Webhooks have same parameters as success, failure and cancel responses.

Failure Response for Payment with MobilePay

On failure the user is redirected to the given failure URL sph-failure-url.

A user is redirected to the failure-url, if processing of the request failed for example due to missing parameters, authentication issues or connectivity issues to the authorizing parties.

| Parameter | Data type | Description |

|---|---|---|

| sph-account | AN | Account identifier from request |

| sph-merchant | AN | Account merchant identifier from request |

| sph-order | ORDER-ID | Merchant defined order identifier |

| sph-request-id | UUID4 | Request identifier from request |

| sph-api-version | VERSION | API version number used in the request |

| sph-session-id | UUID4 | Reference to the form session |

| sph-timestamp | TIMESTAMP | Response timestamp in ISO 8601 combined date and time in UTC. E.g. 2025-09-18T10:33:49Z |

| sph-failure | AN | Failure reason, one of:

|

| signature | ANS | Message signature |

Success and Cancel Responses

The Success and Cancel Responses are exactly the same as in the Payment.

When a user is redirected to the success-url, it means we have successfully completed processing of the request. It does not however mean the card payment or tokenization was accepted by the authorizing parties.

You will find out the actual result using the PaymentAPI (server-to-server) commit or tokenization requests.

Using Payment Highway and MobilePay in Mobile application

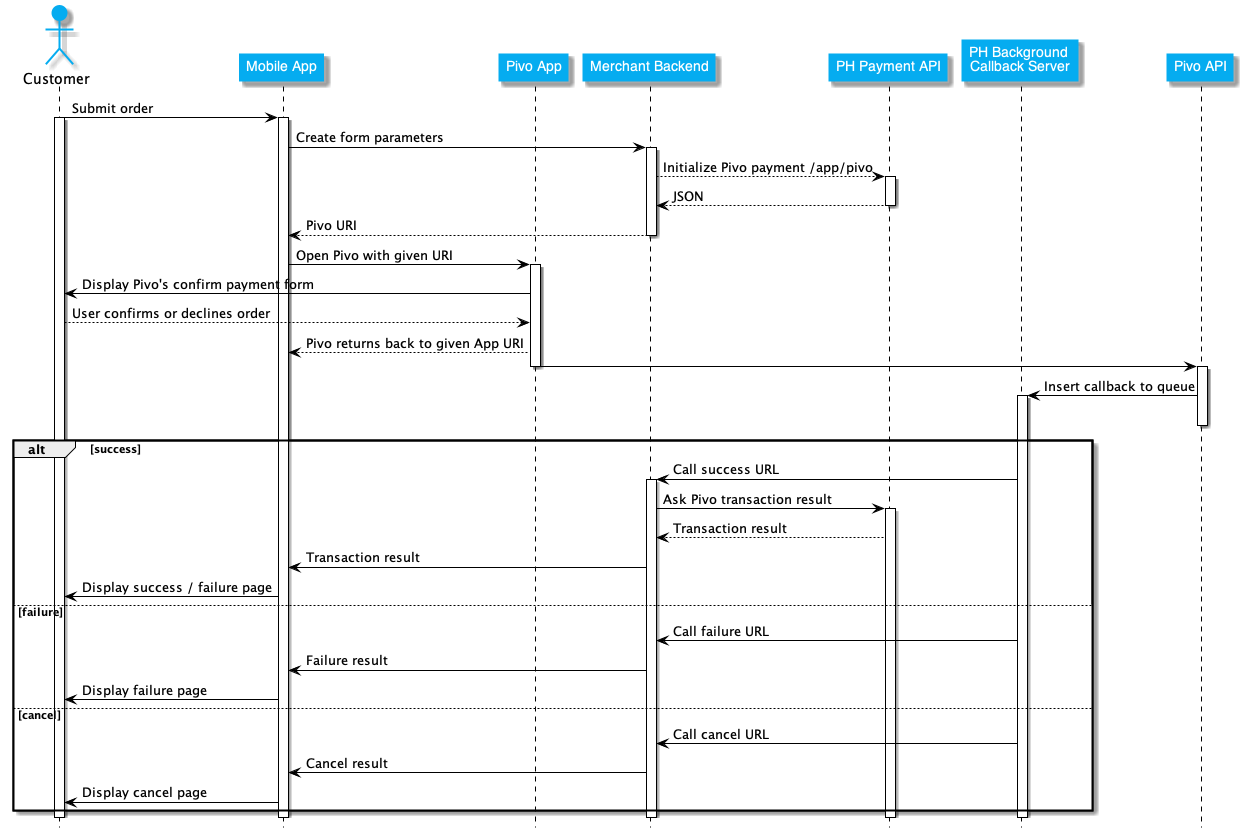

Payment with Pivo

// Generate Pivo form parameters

Long amount = 1999;

String orderId = "1000123A";

String description = "A Box of Dreams. 19,90€";

String phoneNumber = "+358441234567";

String referenceNumber = "1313";

FormContainer formContainer = formBuilder.pivoParametersBuilder(

successUrl,

failureUrl,

cancelUrl,

amount,

orderId,

description

)

.referenceNumber(referenceNumber)

.phoneNumber(phoneNumber)

.build();

// read form parameters

String httpMethod = formContainer.getMethod();

String actionUrl = formContainer.getAction();

List<NameValuePair> fields = formContainer.getFields();

for (NameValuePair field : fields) {

/*

* Build the form for POST-request:

* <input type="hidden" name="field.getName()" value="field.getValue()">

* Or create GET-url:

* ?field.getName()=field.getValue()&...

*/

field.getName();

field.getValue();

}

// Generate Pivo form parameters

var amount = 1990;

var orderId = '1000123A';

var description = 'A Box of Dreams. 19,90€';

var phoneNumber = "+358441234567";

var referenceNumber = "1313";

var formContainer = formBuilder.generatePivoParameters(

successUrl,

failureUrl,

cancelUrl,

language,

amount,

orderId,

description,

referenceNumber,

phoneNumber

);

// read form parameters

var httpMethod = formContainer.method;

var actionUrl = formContainer.getAction();

var fields = formContainer.nameValuePairs;

fields.forEach(function(field) {

/*

* Build the form for POST-request:

* <input type="hidden" name="name" value="value">

* Or create GET-url:

* ?name=value&...

*/

var name = field.first;

var value = field.second;

});

<?php

$amount = "1990";

$currency = "EUR";

$orderId = "1000123A";

$description = "A Box of Dreams. 19,90€";

$phoneNumber = "+358441234567";

$referenceNumber = "1313";

$form = $formbuilder->generatePivoParameters(

$amount,

$orderId,

$description,

$phoneNumber,

$referenceNumber

);

// read form parameters

$httpMethod = $form->getMethod();

$actionUrl = $form->getAction();

$parameters = $form->getParameters();

foreach ($parameters as $key => $value) {

/*

* Build the form for POST-request:

* <input type="hidden" name="$key" value="$value">

* Or create GET-url:

* ?$key=$value&...

*/

echo $key .":". $value;

}

Pivo is a Finnish mobile wallet. With different acquiring agreements, Pivo payments can be made with credit card, Siirto or bank transfer.

HTTP Request

POST /form/view/pivo

| Parameter | Data type | M/O | Description |

|---|---|---|---|

| sph-account | AN | M | Account identifier |

| sph-merchant | AN | M | Account merchant identifier |

| sph-order | ORDER-ID | M | Merchant defined order identifier. Should be unique per transaction. |

| sph-request-id | UUID4 | M | Request identifier |

| sph-amount | N | M | Amount in the lowest currency unit. E.g. 99,00 € = 9900 |

| sph-currency | A | M | Currency code. Only “EUR” supported. |

| sph-timestamp | TIMESTAMP | M | Request timestamp in ISO 8601 combined date and time in UTC. E.g. "2025-09-18T10:32:59Z" |

| sph-success-url | URL | M | Success URL user is redirected to on success |

| sph-failure-url | URL | M | Failure URL user is redirected to on failure |

| sph-cancel-url | URL | M | Cancel URL user is redirected to on cancel |

| sph-webhook-success-url | URL | O | On success, server to server GET request will be made to this url with same parameters as success redirect. |

| sph-webhook-failure-url | URL | O | On failure, server to server GET request will be made to this url with same parameters as failure redirect. |

| sph-webhook-cancel-url | URL | O | On cancel, server to server GET request will be made to this url with same parameters as cancel redirect. |

| sph-webhook-delay | N | O | Webhook call delay in seconds (MAX. 900). If omitted, default value 0 will be used. |

| sph-api-version | VERSION | O | API version number |

| description | ANS | O | The order description shown to the user |

| sph-exit-iframe-on-result | BOOLEAN | O | Exit from iframe after redirection to result URLs. |

| sph-reference-number | AN | O | Reference number. In RF-format or in Finnish reference number format. If omitted, random reference number will be generated by us. Reference number is used when payment type is "siirto" or "account", but not in card payments. With contract where transactions are configured to be settled one by one, reference number is used in every payment method. |

| sph-phone-number | AN | O | When used, phone number will be prefilled to form. Use international format e.g. "+358441234567" |

| sph-splitting-merchant-id | N | O | Sub-merchant ID from the settlements provider. Not to be confused with the sph-merchant value. |

| sph-splitting-amount | N | O | The amount settled to the sub-merchant's account. The rest will be considered as the main merchant's commission. In the smallest currency unit. E.g. 99.99 € = 9999. |

| signature | ANS | M | Message signature in the format 'SPH1 key-id authentication-string' |

Webhooks have same parameters as success, failure and cancel responses.

Success, Cancel and Failure Responses

The Success, Cancel and Failure Responses are exactly the same as in the Payment. When a user is redirected to the success-url, it means we have successfully completed processing the payment request. Pivo transaction must not be committed.

Pivo transactions must not be committed. After getting success-response, You should use Pivo transaction result- or Transaction status-query to get info about payment status.

Payment API

HTTP Interface

The system consists of different resources accessible via HTTPS protocol using the defined mandatory headers for authentication and UTF-8 JSON body for the POST requests.

HTTP response code is always 200 for successful HTTP calls. Anything else indicates a system or communication level failure.

Mandatory headers for both requests and responses are Content-Type, Content-Length and the Custom Headers. Valid values for Content-Type and Content-Length are "application/json; charset=utf-8" and the correct body byte length using UTF-8 encoding.

Headers

In addition to the standard headers, the following custom headers are used.

All the HTTP requests must contain the following headers:

Signature: ”” = The signature header used for authentication and message consistency, see the following section.SPH-Account: ”example_account”= (High level) account name associated with the authentication key.SPH-Merchant: ”example_merchant” = The account’s sub-account, which provides optional merchant level customization.SPH-Timestamp: “yyyy-MM-dd'T'HH:mm:ss'Z'” = Contains the client’s request time in UTC format. Server will check the timestamp does not differ more than five (5) minutes from the correct global UTC time.SPH-Request-Id: ”12ade018-c562-40bc-a4e6-7f63c69fd90a” = Unique one-time- use Request ID in UUID4 format.

Optionally the HTTP request may contain the following headers:

Sph-Api-Version: “yyyyMMdd” = The version date of the JSON response schema. Defaults to “20141215”.

All the HTTP responses contain the following headers:

Signature: ”” see the following section.SPH-Response-Id: ”03c15388-bebc-4872-b3f5-faed0ca65ff6” = Unique one-time- use Response ID in UUID4 format.SPH-Timestamp: “yyyy-MM-dd'T'HH:mm:ss'Z'” which contains the servers response time in UTC format. When the client receives the response, the timestamp must be checked and it must not differ more than five (5) minutes from the correct global UTC time.SPH-Request-Id: ”12ade018-c562-40bc-a4e6-7f63c69fd90a” = Same as the request UUID4.

Errors

try {

// Use Payment Highway's bindings...

} catch (AuthenticationException e) {

// signals a failure to authenticate Payment Highway response

} catch (HttpResponseException e) {

// Signals a non 2xx HTTP response.

// Invalid parameters were supplied to Payment Highway's API

} catch (IOException e) {

// Signals that an I/O exception of some sort has occurred

} catch (Exception e) {

// Something else happened

}

begin

// Use Payment Highway's bindings...

rescue PaymentHighway::Exception::AuthenticationException => e

// Signals a failure to authenticate Payment Highway response

rescue PaymentHighway::Exception::HttpResponseException => e

// Signals a non 2xx HTTP response or a 2xx HTTP response not containing the required headers

// Invalid parameters were supplied to Payment Highway's API

rescue ArgumentError => e

// A function was called with an argument of invalid type

rescue RuntimeError => e

// PaymentHighway functioned in an unexpected way

rescue Exception => e

// Something else happened

PaymentHighwayAPI.initTransaction()

.then(function(initResponse){

// handle response

...

})

.catch(function(error) {

// handle errors

...

});

<?php

try {

// Use Payment Highway's bindings...

}

catch (Exception $e) {

// Something else happened

}

Payment Highway clients can raise exceptions for several reasons. Payment Highway authenticates each request and if there is invalid parameters or a signature mismatch, a HttpResponseException is raised.

The Payment Highway clients also authenticate response messages, and in case of signature mismatch an AuthenticationException will be raised.

It is recommended to gracefully handle exceptions from the API.

Authentication

String serviceUrl = "https://v1-hub-staging.sph-test-solinor.com";

String signatureKeyId = "testKey";

String signatureSecret = "testSecret";

String account = "test";

String merchant = "test_merchantId";

try (PaymentAPI paymentAPI = new PaymentAPI(serviceUrl, signatureKeyId, signatureSecret, account, merchant)) {

// Use paymentAPI to create debit requests etc.

}

service_url = "https://v1-hub-staging.sph-test-solinor.com"

signature_key_id = "testKey"

signature_secret = "testSecret"

account = "test"

merchant = "test_merchantId"

payment_api = PaymentHighway::PaymentApi.new(service_url, signature_key_id, signature_secret, account, merchant)

// Use payment_api to create debit requests etc.

var serviceUrl = "https://v1-hub-staging.sph-test-solinor.com";

var testKey = 'testKey';

var testSecret = 'testSecret';

var account = 'test';

var merchant = 'test_merchantId';

var paymentAPI = new PaymentAPI(

serviceUrl,

testKey,

testSecret,

account,

merchant

);

// Use paymentAPI to create debit requests etc.

<?php

use Solinor\PaymentHighway\PaymentApi;

$serviceUrl = "https://v1-hub-staging.sph-test-solinor.com";

$signatureKeyId = "testKey";

$signatureSecret = "testSecret";

$account = "test";

$merchant = "test_merchantId";

$paymentApi = new PaymentApi(

$serviceUrl,

$signatureKeyId,

$signatureSecret,

$account,

$merchant

);

Signatures

Request authentication and the response signatures are calculated by applying the HMAC- SHA256 method (RFC 2104 - Keyed-Hashing for Message Authentication, http://www.ietf.org/rfc/rfc2104.txt) to the defined concatenated string using the secret key provided to the account user.

A signature is transmitted Hex encoded in the ”Signature” HTTP header with the signature value prefixed with the strings “SPH1” and “secretKeyID”, where the secretKeyID is the ID of the key used in the HMAC calculation. The strings are separated with blank spaces (0x20) thus the header would look like: “Signature: SPH1 secretKeyId signature”

The concatenated string consists of the following fields separated with a new line (“\n”):

# Example of a string used for signature calculation

POST

/transaction/859cefdf-41fa-453a-a6a5-beff35e2f3b8/debit

sph-account:test

sph-merchant:test_merchantId

sph-request-id:12ade018-c562-40bc-a4e6-7f63c69fd90a

sph-timestamp:2014-09-18T14:09:25Z

{”some”:”body”{”json”:1}}

- HTTP method (e.g. “POST” or “GET”)

- HTTP URI without server URL (e.g. ““/transaction/859cefdf-41fa-453a-a6a5- beff35e2f3b8/debit”).

- All the SPH- headers’ trimmed key value pairs concatenated in alphabetic order (by the header name). The header keys must be in lowercase. Each header’s key and value are separated with a colon (“:”) and the different headers are separated with a new line (“\n”).

- HTTP body if exists, empty string if not.

The client must check the response signature in order to verify the authenticity of the response.

Message body

The messaging format is standard compliant JSON using UTF-8 encoding. Each request and response has a set of mandatory and optional fields, which values are validated using the included regular expression rules. A GET request does not have a request body whereas a POST request often does, and both of these always receive response body.

Initialize Add Card Form via Backend

Initialize a new Add Card form via Payment API (backend-to-backend).

The Add Card form allows the end user to submit their payment card information, which is then securely stored to Payment Highway. The merchant receives tokenization ID via the given redirection success url and optionally the webhook. The tokenization ID is used to fetch the actual card token, used to charge the card.

Technically this is the same as add card via Form API, but the URL for the Add Card form is immediately returned in the response of this request, instead of requiring the end user's browser to POST the details via an HTML page, in order to initialize the Add Card form.

when using API version "20210412" or above, sph-session-id and sph-api-version query parameter are included in the success, cancel and failure redirections and webhook calls.

HTTP Request

POST /form/init/add_card

Object request fields

return_urlsmandatoryobject

The URLs where to redirect the user and send the webhook requests to, upon completion of the form.

child fields

strong_customer_authenticationmandatoryobject

Information used in transaction risk analysis (TRA) and can increase the likelihood of the transaction being considered low risk, possibly skipping the requirements of strong customer authentication.

child fields

languageANS

Two letter language code (ISO 639-1). Supported languages are DE, EN, ES, FI, FR, IT, NL, PT, PL, RU, SV. Defaults to browser language.

customerobject

child fields

skip_form_notificationsBOOLEAN

Skip errors displayed on the Payment Highway form and redirect directly to result URL (E.g. "Ecom payments disabled") . Default false.

HTTP Response

Object response fields

urlmandatoryURL

The form URL where the user is redirected to. After submitting the form the user will be sent to one of the specified return URLs.

valid_untilmandatoryTIMESTAMP

Session expriration time.

session_idmandatoryUUID4

Session ID used to fetch the state and details of the form session.

resultobject

child fields

Initialize Click to Pay Form via Backend

Initialize a new Click to Pay form via Payment API (backend-to-backend). The URL for the Click to Pay form is immediately returned in the response of this request, instead of requiring the customer's browser to POST the details via an HTML page, like it is with the Form API calls.

The Click to Pay form allows the customer to pay with Click to Pay.

Click to Pay detects a returning customer device via a cookie. Supplying the customer.email and/or customer.phone_number allows Click to Pay to look for the customer's account in their registry if the device is unknown.

When the form has been completed by the customer the merchant receives a sph-transaction-id via the given redirection sph-success-url and optionally the sph-webhook-success-url. The transaction ID is used to commit the payment.

When using API version "20210412" or above, sph-session-id and sph-api-version query parameter are included in the success, cancel and failure redirections and webhook calls.

HTTP Request

POST /form/init/pay_with_click_to_pay

Object request fields

amountmandatoryAMOUNT

Amount in the smallest currency unit. E.g. 99.99 € = 9999

currencymandatoryCURRENCY

ISO 4217 currency code

ordermandatoryORDER-ID

Merchant defined order identifier. Should be unique per order. See also Order Status search.

return_urlsmandatoryobject

The URLs where to redirect the user and send the webhook requests to, upon completion of the form.

child fields

strong_customer_authenticationmandatoryobject

Information used in transaction risk analysis (TRA) and can increase the likelihood of the transaction being considered low risk, possibly skipping the requirements of strong customer authentication.

child fields

languageANS

Two letter language code (ISO 639-1). Supported languages are DE, EN, ES, FI, FR, IT, NL, PT, PL, RU, SV. Defaults to browser language.

customerobject

child fields

skip_form_notificationsBOOLEAN

Skip errors displayed on the Payment Highway form and redirect directly to result URL (E.g. "Ecom payments disabled") . Default false.

HTTP Response

Object response fields

urlmandatoryURL

The form URL where the user is redirected to. After submitting the form the user will be sent to one of the specified return URLs.

valid_untilmandatoryTIMESTAMP

Session expriration time.

session_idmandatoryUUID4

Session ID used to fetch the state and details of the form session.

resultobject

child fields

Commit Payment

Commit Form Payment

curl -i \

-H "Content-Length: 32" \

-H "Content-Type: application/json" \

-H "SPH-Account: test" \

-H "SPH-Api-Version: 20191204" \

-H "SPH-Merchant: test_merchantId" \

-H "SPH-Request-Id: 1820d2f1-c001-408e-b842-34bfa6b2758d" \

-H "SPH-Timestamp: 2018-10-04T10:41:15Z" \

-H "Signature: SPH1 testKey 1918e69a5dd06fe48844bc3317c9ca257a1fb720bebe25a7da2b3272ee0ff35a" \

--data '{"currency":"EUR","amount":2500}' \

https://v1-hub-staging.sph-test-solinor.com/transaction/52ea5beb-343b-4516-ab70-ede2baa058c8/commit

# Replace the transaction ID with the one retrieved from the Form API sph-transaction-id return parameter.

String transactionId = "52ea5beb-343b-4516-ab70-ede2baa058c8"; // get sph-transaction-id as a GET parameter

String amount = "2499";

String currency = "EUR";

CommitTransactionResponse response = paymentAPI.commitTransaction(transactionId, amount, currency);

response.getResult().getCode(); // 100

transaction_id = "52ea5beb-343b-4516-ab70-ede2baa058c8" # get sph-transaction-id as a GET parameter

amount = 2499

currency = "EUR"

commit_transaction_response = payment_api.commit_transaction(transaction_id, amount, currency)

commit_transaction_response.result.code // 100

var transactionId = '52ea5beb-343b-4516-ab70-ede2baa058c8'; // get sph-transaction-id as a GET parameter

var amount = 2499;

var currency = 'EUR';

var request = new paymentHighway.CommitTransactionRequest(amount, currency);

paymentAPI.commitTransaction(transactionId, request)

.then(function(response){

var resultCode = response.result.code; // Should be 100, if OK

});

<?php

$transactionId = "52ea5beb-343b-4516-ab70-ede2baa058c8"; // get sph-transaction-id as a GET parameter

$amount = 2499;

$currency = "EUR";

$response = $paymentApi->commitFormTransaction($transactionId, $amount, $currency );

$response->body->result->code; // 100

JSON Response

{

"committed": true,

"committed_amount": 2499,

"card_token": "77ffbaca-9658-4aef-ac9e-f85da3164bdb",

"recurring": true,

"filing_code": "181004705200",

"cardholder_authentication": "no",

"card": {

"type": "Visa",

"partial_pan": "0024",

"expire_year": "2023",

"expire_month": "11",

"cvc_required": "no",

"bin": "415301",

"funding": "debit",

"country_code": "FI",

"category": "unknown",

"card_fingerprint": "da6b0df36efd17c0e7f6967b9e440a0c61b6bd3d96b62f14c90155a1fb883597",

"pan_fingerprint": "e858e18daac509247f463292641237d6a74ce44e0971ba2de4a14874928a8805"

},

"result": {

"code": 100,

"message": "OK"

}

}

In order to finalize (capture) a payment performed via Form API ("Payment", "Payment & Add Card" or "Payment with token and CVC"), the corresponding sph-transaction-id must be committed.

The same applies for a "Charge a card" payment API request when the automatic commit is disabled for auth & capture using the "commit" parameter as "false". In this case the transaction ID must be committed as well.

The commit amount must be equal or less than the original payment amount. One payment can only be committed once.

Up to 7 days old transactions can be committed.

In order to find out the result of the form payment without committing it, use the "Transaction result" request instead.

HTTP Request

POST /transaction/<:transaction_id>/commit

Object request fields

amountmandatoryAMOUNT

Amount in the smallest currency unit. E.g. 99.99 € = 9999

currencymandatoryCURRENCY

ISO 4217 currency code

HTTP Response

Object response fields

card_tokenUUID4

Present on a successful commit. See also card.cvc_required below.

cardobject

Present on a successful commit. See also card.cvc_required below.

child fields

customerobject

child fields

committedmandatoryBOOLEAN

committed_amountmandatoryAMOUNT

Omitted if "committed" is false

filing_codeAN

approved_amountmandatoryAMOUNT

Approved amount that covers only automated fuel dispenser case when supports_partial_approval is used in the request.

reference_numberAN

Reference number. In RF-format or in Finnish reference number format.

resultobject

child fields

acquirerobject

child fields

acquirer_response_codeAN

Acquirer specific response code

authorizerAN

The card issuer or scheme network which gave the authorization response (acquirer_response_code)

Transaction result

Used to find out whether or not an uncommitted transaction succeeded, without actually committing (capturing) it.

For Pivo payments, check Pivo transaction result

HTTP Request

GET /transaction/<:transaction_id>/result

Responses

Responses are exactly the same as in the Commit.

Pivo transaction result

UUID transactionId = UUID.fromString("327c6f29-9b46-40b9-b85b-85e908015d92");

PivoTransactionResultResponse response = paymentAPI.pivoTransactionResult(transactionId);

paymentAPI.pivoTransactionResult(transactionId).then(function(res) {

const transactionResult = res;

});

<?php

$response = $paymentApi->pivoTransactionResult($transactionId);

JSON Response for Pivo transaction

{

"state": "refunded",

"current_amount": 990,

"amount": 1000,

"payment_type": "siirto",

"archive_id": "20180523593064010087",

"customer": {

"network_address": "127.0.0.1"

},

"reference_number": "1805231300333",

"result": {

"code": 100,

"message": "OK"

}

}

Used to find out whether or not a Pivo transaction succeeded.

HTTP Request

GET /transaction/<:transaction_id>/pivo/result

Responses

Pivo transaction response object fields

statemandatoryA

Pivo transaction state (‘pending’, ‘paid’, ‘cancelled’, ‘rejected’ or ‘refunded’)

customerobject

child fields

amountmandatoryAMOUNT

Amount in the smallest currency unit. E.g. 99.99 € = 9999

current_amountAMOUNT

Amount after possible reversals

reference_numberAN

Reference number. In RF-format or in Finnish reference number format.

archive_idAN

payment_typeA

Payment method of the Pivo payment. ‘account’: Payment order paid as Bank account transfer, ‘card’: Payment order paid as Card payment, ‘siirto’ Payment order paid as siirto payment.

resultobject

child fields

Charge a card

In order to do safe transactions, an execution model is used where the first call to /transaction acquires a financial transaction handle, later referred as “ID”, which ensures the transaction is executed exactly once. Afterwards it is possible to execute a debit transactions using the received ID handle. If the execution fails, the command can be repeated in order to confirm the transaction with the particular ID has been processed. After executing the command, the status of the transaction can be checked by executing a GET request to the /transaction/<:transaction_id> resource.

Init transaction handle

Init the transaction handle and get the ID for it.

Init transaction handle

curl -i \

-H "Content-Length: 0" \

-H "Content-Type: application/json" \

-H "SPH-Account: test" \

-H "SPH-Api-Version: 20191204" \

-H "SPH-Merchant: test_merchantId" \

-H "SPH-Request-Id: 83d6195d-b2f5-4d65-a5cd-7289dda1811c" \

-H "SPH-Timestamp: 2018-10-04T10:19:45Z" \

-H "Signature: SPH1 testKey 6ee85e625fa2bd1fafa6cef6a7f9fe3b7a81e62115f24ece1cff70b8338d928d" \

--data '' \

https://v1-hub-staging.sph-test-solinor.com/transaction

InitTransactionResponse initResponse = paymentAPI.initTransaction();

initResponse.getResult().getCode(); // 100

init_response = payment_api.init_transaction_handle

init_response.result.code // 100

paymentAPI.initTransaction()

.then(function(response){

var resultCode = response.result.code; // 100

});

<?php

$response = $paymentApi->initTransaction();

$response->body->result->code; // 100

JSON Response

{

"id": "52ea5beb-343b-4516-ab70-ede2baa058c8",

"result": {

"code": 100,

"message": "OK"

}

}

HTTP Request

POST /transaction

HTTP Response

Object response fields

idmandatoryUUID4

The handle for the following requests.

resultobject

child fields

Charging a card token

After the introduction of the European PSD2 directive, the electronic payment transactions are categorised in so called customer initiated transactions (CIT) and merchant initiated transactions (MIT).

Customer initiated transactions are scenarios, where the customer actively takes part in the payment process. This also includes token, or "one-click" purchases, where the transaction uses a previously saved payment method.